Revolutionize Finance with Intelligent RPA & AI

Revolutionize Finance with Intelligent RPA & AI

Revolutionize Finance with Intelligent RPA & AI

Optimize reconciliation, reduce operational costs, and strengthen risk management by integrating smart automation into your financial workflows—driving accuracy, agility, and competitive advantage.

Why Automation?

Why Automation?

RPA automates repetitive finance tasks—such as transaction processing, reconciliations, and reporting—improving efficiency, accuracy, and compliance while reducing operational costs and turnaround times.

Transaction Processing Automation

Streamline high-volume transaction workflows—from payment initiation through settlement—by automating data entry, validation, and posting across multiple systems.

Process up to 10x more transactions per hour

Reduce posting errors by 90%

Achieve straight-through processing rates of 85%

Transaction Processing Automation

Streamline high-volume transaction workflows—from payment initiation through settlement—by automating data entry, validation, and posting across multiple systems.

Process up to 10x more transactions per hour

Reduce posting errors by 90%

Achieve straight-through processing rates of 85%

Transaction Processing Automation

Streamline high-volume transaction workflows—from payment initiation through settlement—by automating data entry, validation, and posting across multiple systems.

Process up to 10x more transactions per hour

Reduce posting errors by 90%

Achieve straight-through processing rates of 85%

Transaction Processing Automation

Streamline high-volume transaction workflows—from payment initiation through settlement—by automating data entry, validation, and posting across multiple systems.

Process up to 10x more transactions per hour

Reduce posting errors by 90%

Achieve straight-through processing rates of 85%

Financial Close & Consolidation

Accelerate month-end and quarter-end close by automating journal entries, intercompany reconciliations, and variance analysis—delivering timely, trustworthy financial statements.

Shorten close cycle by 50%

Automate 95% of routine journal postings

Increase consolidation accuracy to 99.5%

Financial Close & Consolidation

Accelerate month-end and quarter-end close by automating journal entries, intercompany reconciliations, and variance analysis—delivering timely, trustworthy financial statements.

Shorten close cycle by 50%

Automate 95% of routine journal postings

Increase consolidation accuracy to 99.5%

Financial Close & Consolidation

Accelerate month-end and quarter-end close by automating journal entries, intercompany reconciliations, and variance analysis—delivering timely, trustworthy financial statements.

Shorten close cycle by 50%

Automate 95% of routine journal postings

Increase consolidation accuracy to 99.5%

Financial Close & Consolidation

Accelerate month-end and quarter-end close by automating journal entries, intercompany reconciliations, and variance analysis—delivering timely, trustworthy financial statements.

Shorten close cycle by 50%

Automate 95% of routine journal postings

Increase consolidation accuracy to 99.5%

Regulatory Reporting Automation

Embed bots to gather, validate, and compile data for regulatory filings—ensuring audit-ready reports, reducing manual rework, and maintaining compliance with evolving standards.

Generate 100% of mandatory reports automatically

Decrease manual rework by 80%

Reduce regulatory submission lead-time by 60%

Regulatory Reporting Automation

Embed bots to gather, validate, and compile data for regulatory filings—ensuring audit-ready reports, reducing manual rework, and maintaining compliance with evolving standards.

Generate 100% of mandatory reports automatically

Decrease manual rework by 80%

Reduce regulatory submission lead-time by 60%

Regulatory Reporting Automation

Embed bots to gather, validate, and compile data for regulatory filings—ensuring audit-ready reports, reducing manual rework, and maintaining compliance with evolving standards.

Generate 100% of mandatory reports automatically

Decrease manual rework by 80%

Reduce regulatory submission lead-time by 60%

Regulatory Reporting Automation

Embed bots to gather, validate, and compile data for regulatory filings—ensuring audit-ready reports, reducing manual rework, and maintaining compliance with evolving standards.

Generate 100% of mandatory reports automatically

Decrease manual rework by 80%

Reduce regulatory submission lead-time by 60%

Transforming Finance with Agentic AI & RPA

Financial services firms are deploying Agentic AI and RPA to automate core finance functions—such as transaction processing, reconciliations, and financial close—reducing manual errors, accelerating reporting cycles, and enabling teams to focus on strategic insights and growth.

Enhance Regulatory Reporting

✔️ Aggregate data from disparate systems

✔️ Validate and transform data against regulatory schemas

✔️ Populate XBRL, IFRS, or local filing formats

✔️ Maintain audit-ready logs of every submission

✔️ Speed up report generation and reduce compliance risk

Automate Reconciliation Workflows

✔️ Match bank statements to ledger entries

✔️ Identify and flag exceptions for review

✔️ Post adjustment entries automatically

✔️ Generate reconciliation reports

✔️ Reduce manual intervention by 80%

Improve Credit & Loan Origination

✔️ Extract and validate borrower data from applications

✔️ Run automated credit-scoring models

✔️ Generate and send loan approvals or declinations

✔️ Integrate with underwriting systems seamlessly

✔️ Reduce loan processing times from days to hours

Boost Treasury & Cash Management

✔️ Automate daily cash position reporting

✔️ Trigger funding or investment tasks based on thresholds

✔️ Execute FX rate feeds and trade confirmations

✔️ Reconcile treasury transactions automatically

✔️ Enhance liquidity forecasting accuracy

Advanced Analytics & Forecasting

✔️ Collect historical financial data across systems

✔️ Run automated variance and trend analyses

✔️ Generate predictive cash-flow and budget forecasts

✔️ Deliver interactive dashboards to stakeholders

✔️ Empower data-driven decision-making

Accelerate Transaction Processing

✔️ Automate payment initiation and settlement

✔️ Validate transaction data in real time

✔️ Eliminate manual posting errors

✔️ Enable 24/7 processing availability

✔️ Achieve straight-through processing

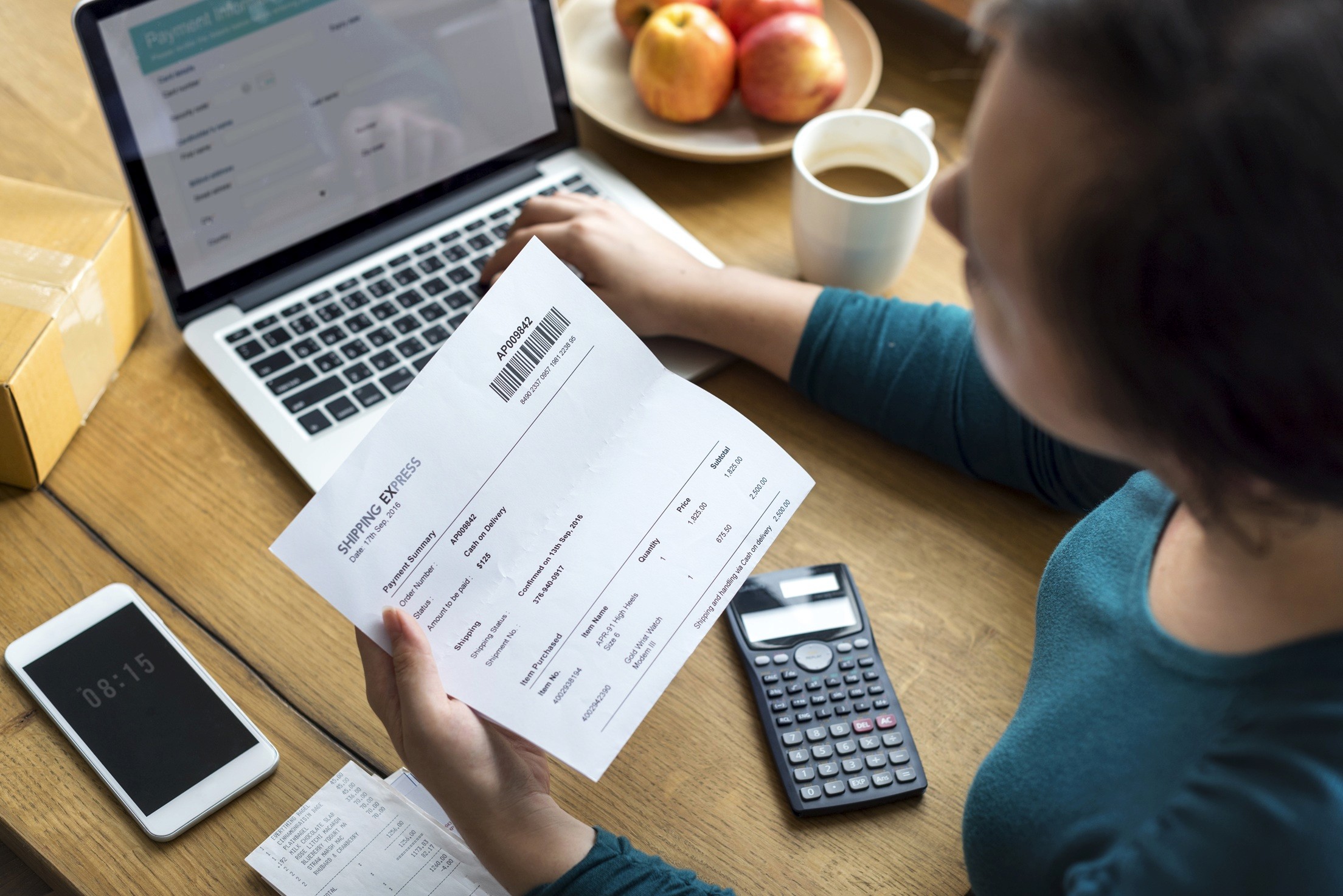

Streamline Accounts Payable & Receivable

✔️ Auto-capture and OCR-validate invoices

✔️ Match POs, goods receipts, and invoices

✔️ Trigger payment runs based on approval rules

✔️ Reconcile incoming payments against invoices

✔️ Shorten DSO (Days Sales Outstanding)

Optimize Financial Close & Consolidation

✔️ Schedule and post recurring journal entries

✔️ Reconcile intercompany accounts automatically

✔️ Roll-forward balances and currency conversions

✔️ Generate variance analyses with minimal manual review

✔️ Deliver month-end close in days, not weeks

Enhance Regulatory Reporting

✔️ Aggregate data from disparate systems

✔️ Validate and transform data against regulatory schemas

✔️ Populate XBRL, IFRS, or local filing formats

✔️ Maintain audit-ready logs of every submission

✔️ Speed up report generation and reduce compliance risk

Automate Reconciliation Workflows

✔️ Match bank statements to ledger entries

✔️ Identify and flag exceptions for review

✔️ Post adjustment entries automatically

✔️ Generate reconciliation reports

✔️ Reduce manual intervention by 80%

Improve Credit & Loan Origination

✔️ Extract and validate borrower data from applications

✔️ Run automated credit-scoring models

✔️ Generate and send loan approvals or declinations

✔️ Integrate with underwriting systems seamlessly

✔️ Reduce loan processing times from days to hours

Boost Treasury & Cash Management

✔️ Automate daily cash position reporting

✔️ Trigger funding or investment tasks based on thresholds

✔️ Execute FX rate feeds and trade confirmations

✔️ Reconcile treasury transactions automatically

✔️ Enhance liquidity forecasting accuracy

Advanced Analytics & Forecasting

✔️ Collect historical financial data across systems

✔️ Run automated variance and trend analyses

✔️ Generate predictive cash-flow and budget forecasts

✔️ Deliver interactive dashboards to stakeholders

✔️ Empower data-driven decision-making

Accelerate Transaction Processing

✔️ Automate payment initiation and settlement

✔️ Validate transaction data in real time

✔️ Eliminate manual posting errors

✔️ Enable 24/7 processing availability

✔️ Achieve straight-through processing

Streamline Accounts Payable & Receivable

✔️ Auto-capture and OCR-validate invoices

✔️ Match POs, goods receipts, and invoices

✔️ Trigger payment runs based on approval rules

✔️ Reconcile incoming payments against invoices

✔️ Shorten DSO (Days Sales Outstanding)

Optimize Financial Close & Consolidation

✔️ Schedule and post recurring journal entries

✔️ Reconcile intercompany accounts automatically

✔️ Roll-forward balances and currency conversions

✔️ Generate variance analyses with minimal manual review

✔️ Deliver month-end close in days, not weeks

Enhance Regulatory Reporting

✔️ Aggregate data from disparate systems

✔️ Validate and transform data against regulatory schemas

✔️ Populate XBRL, IFRS, or local filing formats

✔️ Maintain audit-ready logs of every submission

✔️ Speed up report generation and reduce compliance risk

Automate Reconciliation Workflows

✔️ Match bank statements to ledger entries

✔️ Identify and flag exceptions for review

✔️ Post adjustment entries automatically

✔️ Generate reconciliation reports

✔️ Reduce manual intervention by 80%

Improve Credit & Loan Origination

✔️ Extract and validate borrower data from applications

✔️ Run automated credit-scoring models

✔️ Generate and send loan approvals or declinations

✔️ Integrate with underwriting systems seamlessly

✔️ Reduce loan processing times from days to hours

Boost Treasury & Cash Management

✔️ Automate daily cash position reporting

✔️ Trigger funding or investment tasks based on thresholds

✔️ Execute FX rate feeds and trade confirmations

✔️ Reconcile treasury transactions automatically

✔️ Enhance liquidity forecasting accuracy

Advanced Analytics & Forecasting

✔️ Collect historical financial data across systems

✔️ Run automated variance and trend analyses

✔️ Generate predictive cash-flow and budget forecasts

✔️ Deliver interactive dashboards to stakeholders

✔️ Empower data-driven decision-making

Accelerate Transaction Processing

✔️ Automate payment initiation and settlement

✔️ Validate transaction data in real time

✔️ Eliminate manual posting errors

✔️ Enable 24/7 processing availability

✔️ Achieve straight-through processing

Streamline Accounts Payable & Receivable

✔️ Auto-capture and OCR-validate invoices

✔️ Match POs, goods receipts, and invoices

✔️ Trigger payment runs based on approval rules

✔️ Reconcile incoming payments against invoices

✔️ Shorten DSO (Days Sales Outstanding)

Optimize Financial Close & Consolidation

✔️ Schedule and post recurring journal entries

✔️ Reconcile intercompany accounts automatically

✔️ Roll-forward balances and currency conversions

✔️ Generate variance analyses with minimal manual review

✔️ Deliver month-end close in days, not weeks

Finance RPA & AI Automation Framework

Finance RPA & AI Automation Framework

Leverage RPA and AI to streamline finance operations, minimize manual tasks, and deliver real-time insights—enhancing efficiency, accuracy, and compliance across all core financial functions.

Identify & Prioritize

Identify & Prioritize

Identify & Prioritize

Analyze existing finance workflows to spot repetitive, high-volume tasks—then rank them by impact and compliance needs to focus on the most valuable opportunities first.

Prototype & Validate

Prototype & Validate

Prototype & Validate

Design and test lightweight automation pilots for chosen processes—using RPA bots for rule-based tasks and AI models for exception handling—to confirm benefits and refine logic.

Build & Integrate

Build & Integrate

Build & Integrate

Develop production-ready bots and embed AI-driven decision steps into transaction processing, reconciliations, and reporting. Connect seamlessly with ERP, treasury, and reporting systems.

Govern & Evolve

Govern & Evolve

Govern & Evolve

Launch a finance control tower to track performance, SLAs, and exceptions. Use ongoing analytics to fine-tune workflows, expand automation coverage, and maintain regulatory compliance.

Automate end-to-end transaction workflows—including payment initiation, validation, and settlement—to deliver 24/7 straight-through processing with near-zero errors.

Transaction Processing

Treasury & Cash

Reporting & Compliance

Analytics & Forecasting

Automate end-to-end transaction workflows—including payment initiation, validation, and settlement—to deliver 24/7 straight-through processing with near-zero errors.

Transaction Processing

Treasury & Cash

Reporting & Compliance

Analytics & Forecasting

Automate end-to-end transaction workflows—including payment initiation, validation, and settlement—to deliver 24/7 straight-through processing with near-zero errors.

Transaction Processing

Treasury & Cash

Reporting & Compliance

Analytics & Forecasting

Automate end-to-end transaction workflows—including payment initiation, validation, and settlement—to deliver 24/7 straight-through processing with near-zero errors.

Transaction Processing

Treasury & Cash

Reporting & Compliance

Analytics & Forecasting

Realizing Automation Benefits in Finance: Cost Efficiency, Precision, and Strategic Insight

40–60%

Cost Savings, Automating reconciliations and data entry cuts labor costs by up to 60%, freeing teams for strategic work.

90%

Error Reduction, Robotic checks and audit trails eliminate about 90% of manual entry mistakes for higher data integrity.

24/7

Customer Support, RPA chatbots handle routine inquiries around the clock—improving response times by 80%.

70% Faster Close

Automated journal entries and reconciliations reduce month-end close times by 70%, enabling real-time insights.